🚀 Setting up Your First Crypto Trading Bot

Welcome to PrimeAutomation! This guide will help you set up your first automated crypto trading bot in just a few steps.

🧠 Step 1: Choose Your Strategy

🔗 Navigate to

New Botin the navigation bar

⚙️ ClickAlgo Bots, AI Bots or Grid Bots - we suggest starting with Algo Bots

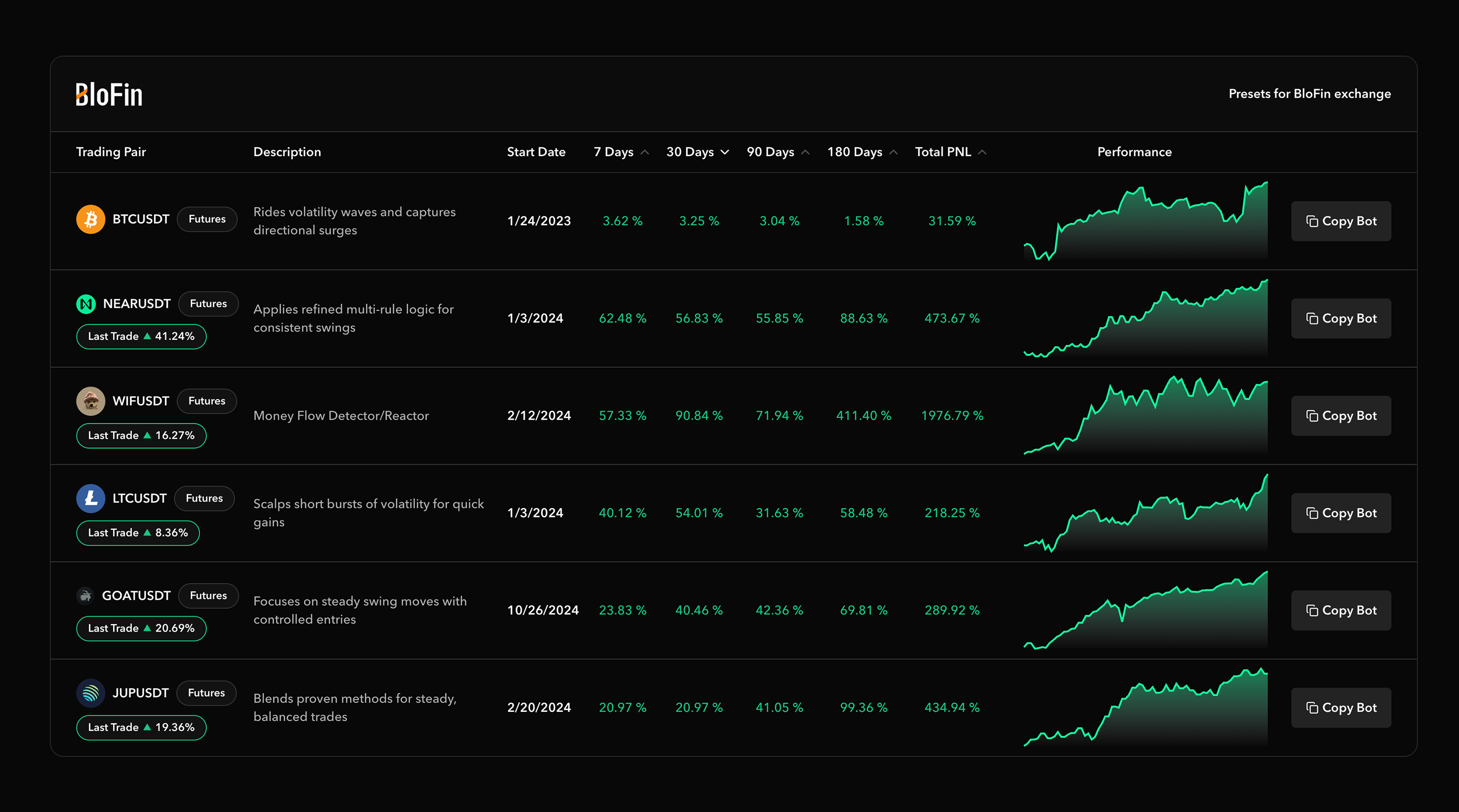

If you clicked Algo Bots, now you'll see a list of curated strategies by PrimeAutomation.

|

|---|

| List of bots |

All strategies are thoroughly backtested and come with key data points to help you decide:

📊 Strategy Data Shown

- Trading Pair – e.g.,

AVAX/USDT,PEPE/USDT - Description – e.g.,

"30m DeLo Bot"or"4h Swing Partials"(timeframe and strategy type) - Total PNL (%) – Net profit/loss since strategy inception

- Start Date – When the bot began tracking data

- Performance Over Time – Metrics over:

- 1 month

- 2 months

- 3 months

- 6 months

💡 AI-powered strategies

These are marked with an AI icon. These use machine learning to optimize entries/exits and may provide a performance edge. AI is widely used in trading but here are the main advantages of using ChartPrime's Premium AI strategies.

Learn more about the PrimeAutomation AI strategies in the video below:

1. Adaptive Intelligence

Our AI models learn from vast amounts of historical and live market data. They don't rely on fixed rules — instead, they adapt to changing market conditions, making them more robust during volatility.

2. Data-Driven Precision

Unlike emotional or gut-based decisions, Our AI strategies are built on statistical models and pattern recognition, leading to more consistent performance across different asset classes and timeframes.

3. Speed & Scale

Our AI systems can analyze thousands of assets, indicators, and timeframes simultaneously — far faster than any human. This allows them to detect and act on opportunities in milliseconds.

4. Backtesting & Optimization

Our Machine learning models can be trained on millions of data points and fine-tuned for optimal performance using techniques like cross-validation, genetic algorithms, and reinforcement learning.

5. Noise Filtering

Our AI excels at identifying real signals in noisy markets by using deep learning or statistical filters. It can detect subtle shifts that traditional technical indicators might miss.

🤖 Step 2: Pick & Copy a Bot

🎯 Select a bot that matches either:

- The asset you like to trade

- A performance history you're comfortable with

🙋♂️ Not sure what to pick?

👉 Watch this helpful video:[INSERT VIDEO LINK]

Once decided:

✅ Click

Copy Botnext to your chosen strategy.

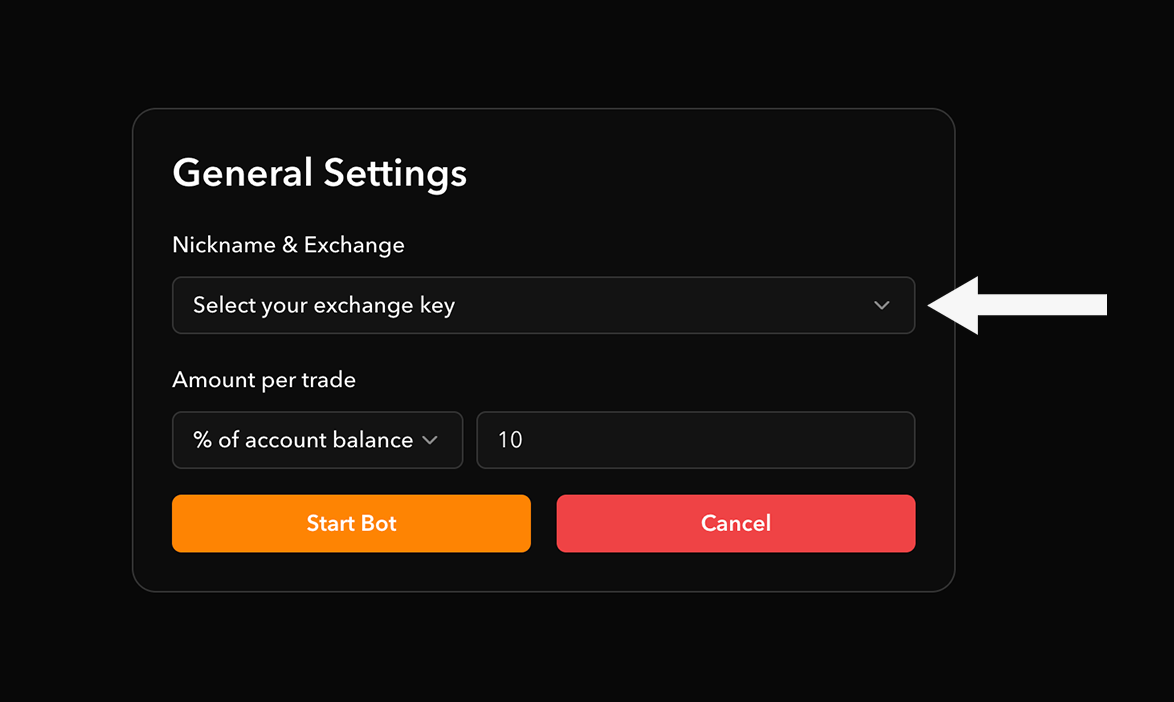

🔑 Step 3: Link Your Exchange

Select the exchange where you want the bot to trade.

|

|---|

| Example: Select an exchange from the dropdown menu |

Example:

- If you want to trade via your BloFin account, choose your connected BloFin key from the dropdown.

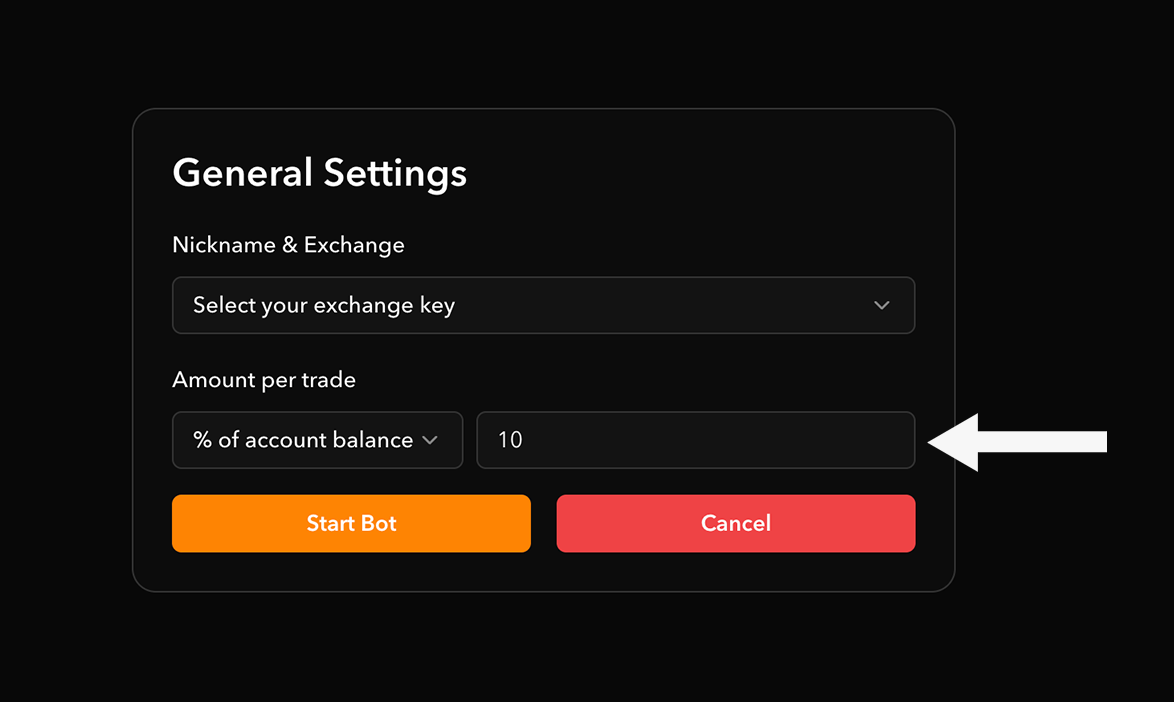

💰 Step 4: Set Your Investment Amount

Choose how much you want the bot to trade with:

- A fixed dollar amount (e.g., $200), OR

- A percentage of your balance (recommended ✅)

|

|---|

| Example: Using 10% of account balance |

⚠️ All bots are set to 3x leverage by default, optimized by PrimeAutomation's backtests.

📈 Using a % of your balance allows your position size to scale dynamically as your account grows.

🎉 All Set – You're Now an Automated Trader!

🚀 Navigate to

Dashboardfrom the navigation bar to:

- View your live bots

- Track PNL

- Monitor trades in real-time